Argentina: Milei accused of fraud and money laundering after $LIBRA memecoin collapse – What happened?

The Argentine opposition is demanding a congressional investigation into the multimillion-dollar losses caused by the launch of the $LIBRA token, which was promoted by President Javier Milei

At 5:01 p.m. ET, Argentine President Javier Milei posted on X, providing evidence for accusations of fraud and money laundering related to the $LIBRA memecoin—a type of token whose value is driven by speculation and social media hype

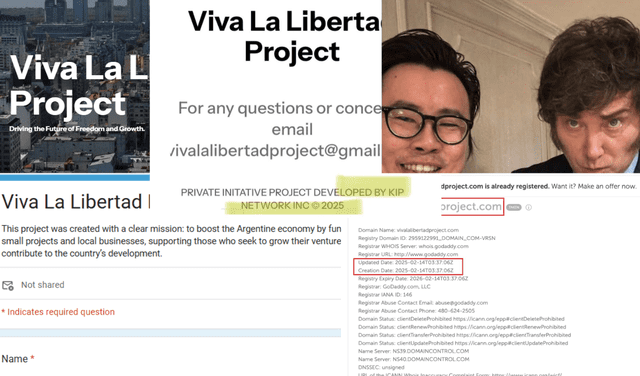

A few hours before the collapse, a website linked to $LIBRA contained a Google form for “funding requests,” reportedly created just before the token’s launch. The Kobeissi Letter, a leading capital markets analysis account on X, revealed that the domain was registered for only one year, with no public information on its owner.

Suspicions grew when economist Eduardo Garzón posted on X, exposing that Kip Network, the entity behind the Viva La Libertad project, had direct ties to Milei. “The owner knows Milei, and they have attended events together,” Garzón claimed, sharing images as proof.

Viva La Libertad Project. Foto: composición LR/The Kobeissi Letter/Eduardo Garzón

The collapse of $LIBRA

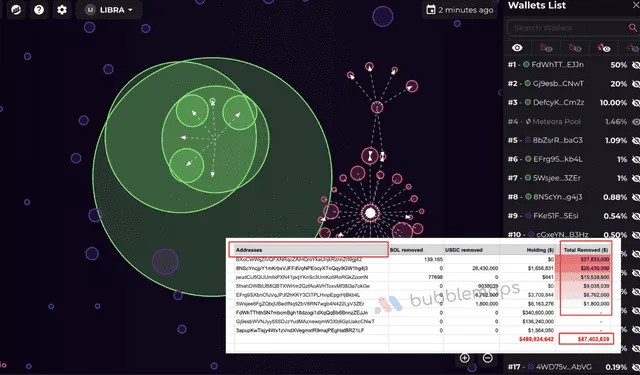

From the start, $LIBRA’s distribution was manipulated. A single group controlled 82% of the total supply, giving them absolute control over its price. However, this was never disclosed to the public, leading many investors to buy in without understanding the real risks.

Just three hours after launch, insiders began selling large quantities of tokens, withdrawing $87.4 million before the price collapsed. This flood of tokens into the market triggered a steep decline in value.

Grupos de tokens de Libra y retiro de US$ 87,4 millones. Fuente: Bubblemaps

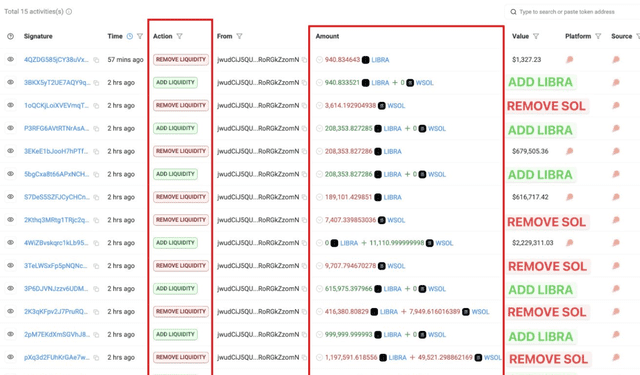

Rather than selling directly on exchanges, insiders manipulated the token’s liquidity using Meteora, a financial platform on the Solana blockchain. They deposited large amounts of $LIBRA but instead of maintaining balance, they withdrew stablecoins (digital dollars) and SOL (Solana’s main cryptocurrency). This drained financial backing from the token, accelerating its crash.

Before collapsing, $LIBRA reached a market cap of $4.6 billion, attracting thousands of retail investors. However, as the price fell, insiders offloaded their holdings while small investors unknowingly bought into a freefall.

Retiro de SOL. Fuente: The Kobeissi Letter

One of the fastest retail capital destructions in history

According to data from Dex Screener, $LIBRA briefly peaked at a $4.56 billion market cap at 10:30 p.m. UTC on February 14, only to plunge 94% to $257 million within 11 hours.

The Kobeissi Letter tweeted:

“It’s official. One of the five biggest memecoin launches in history has resulted in the fastest retail capital destruction ever. Since launch, the coin has only had four green hourly candles. Traders are reporting $LIBRA losses of -$5 million or more. Truly insane.”

$LIBRA hoy. Foto: The Kobeissi Letter

Understanding the $LIBRA scheme

Imagine a market where oranges ($LIBRA) are sold. People buy them with money (USD or SOL). In a normal situation, if many people buy oranges, prices remain stable or rise.

What did the insiders do? Instead of selling directly, they flooded the market with oranges while gradually removing the available money. This left many oranges but no cash in circulation. When they finally decided to sell, there was not enough money left to buy them, causing a 90% crash.

Journalist Alejandro Gamero explained:

“If Donald Trump had sold $50 million of his own $TRUMP tokens when they hit $75, he would have triggered the same collapse as $LIBRA. But he can’t do that because it would be fraud—controlling the majority supply means controlling the market.”

Current value of $LIBRA

When Milei promoted $LIBRA, it was worth $0.000001. Within minutes, it surged to $1 and peaked at $5.2. Currently, it sits at $0.21 and is on its way to zero.

Changpeng Zhao (CZ), co-founder and former CEO of Binance, commented on X that this could have been a “substantial opportunity for Argentina if handled correctly.”

Calls for Milei’s resignation

According to La Nación, the opposition is calling for a Congressional commission to investigate Milei over the $LIBRA scandal.

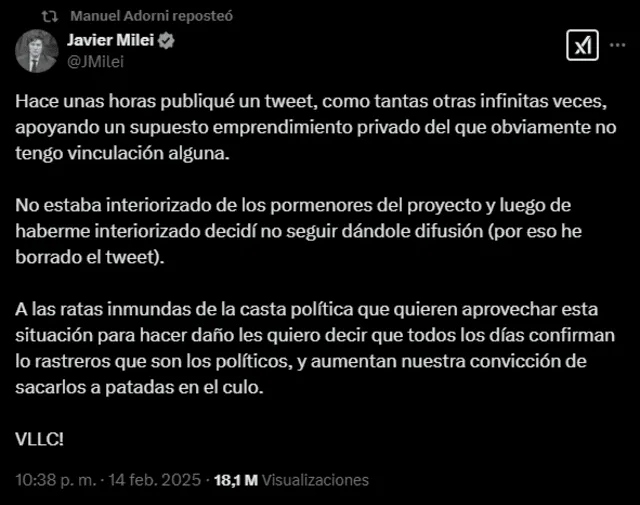

Último post en X de Javier Milei sobre caso $LIBRA. Foto: captura de pantalla

Lawmakers from the Coalición Cívica demand an inquiry to determine if the president engaged in misconduct by promoting a cryptocurrency that caused massive investor losses in just hours.

Deputy Maximiliano Ferraro stated:

“The President may have violated the Public Ethics Law, Article 265 of the Penal Code, and Article 19 of the Financial Institutions Law.”

Meanwhile, Deputy Esteban Paulón of the Socialist Party submitted a resolution requesting Chief of Staff Guillermo Francos to appear before Congress to explain the scandal.

Milei responded on X, blaming political opponents, and his post was reshared by presidential spokesperson Manuel Adorni.